Treasury and Finacial Report 2002 |

|

Treasures Report

by John Nelson

The financial year 2001/2002 reported both an increase in income and associated expenditure of the Centre when compared to the previous year. This increase has largely been brought about by the increase in grants and donations to the Centre (a large part of which has been associated with the purchase of new premises). The results and the basis of comparison to the previous year are explained below.

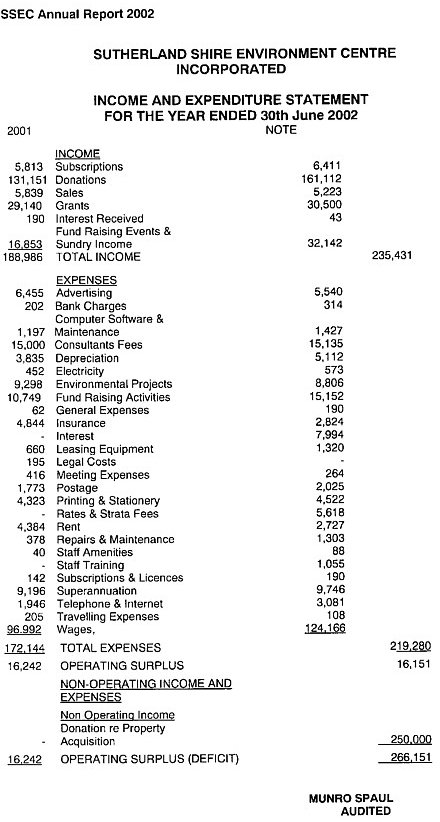

Operating Deficit

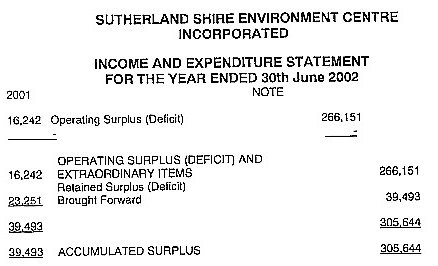

At 30 June, 2002 the accounts of the Centre showed an operating surplus of $266,151 compared to an operating surplus in the previous year of $16,242.

Income

Total Income for the year $235,431 is again up on the previous years amount of $188,986.

Items of note within Income of the Centre included:

- the modest increase in Subscription Income;

- a large increase in Donations (a major component being associated with the premises purchase);

- an increase of Grant moneys (relating to grants from Local Council and State and Federal Governments); and,

- a substantial increase in income generated from sales as a result of consulting services provided by the Centre.

Again, as in past years, we continue to operate financially with the generous donations of individuals and organisations and the time devoted by a solid core of devoted volunteers.

It goes without saying that without such support the Centre could not afford to continue to operate as effectively as it does. This year we again saw substantial receipts from the Street Stalls and it should be noted that revenue earned through this and the other core fund raising activities (such as the Annual Dinner and Raffle) help to keep the doors of the Centre open over the year.

Expenditure

Total Expenditure for the year of $219,280 represents an increase over the previous year of $172,744.

Major areas of variation in expenditure over last year are seen in:

- Environmental Projects with a number of key campaigns and forums being co-ordinated by the Centre;

- Fund Raising Activities where costs increased over last year's level;

- Postage, Printing & Stationery - which shows a modest increase over the previous year as a result of more activity generally within the Centre;

- Superannuation and Wages representing the full costs of staffing the Centre (and not recovering these against projects); and

- Accommodation Costs. With the move to the new premises the Centre now has a mortgage to service and increased auxiliary expenses associated with a larger office.

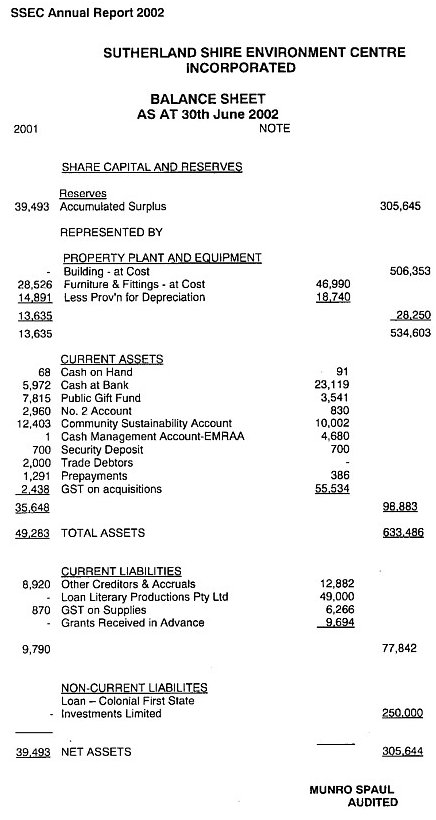

Balance Sheet

Turning to the Balance Sheet, the effect of the purchase of the new premises is reflected in both Fixed Assets (to represent the capital cost of the office) and the Loan/Mortgage (reflecting the moneys borrowed to procure the office).

Other Creditors & Accrual relates to the accrual of the outstanding Tax liability as at balance date (30 June) and Employer Superannuation contributions. Offsetting this, we have funds available in various other bank and deposit accounts as shown under Current assets. Of the amounts held in bank accounts approx. $24,000 relates to grants and is earmarked for expenditure during the next financial year.

The addition of new equipment in the Centre's Offices is also reflected in the increases as shown under Property Plant and Equipment. These purchases were seen as necessary to provide an infrastructure under which the Centre can continue to expand.

The new premises and new equipment purchased throughout the past year are expected to yield significant benefits to the operation of the Centre. These expenditures have major impact on the Balance Sheet for the Centre and its cash flows. In the coming year, new sources of revenue will be sought to ensure the successful on-going operations of the Centre.

Special Mention

Special mention and thanks are extended to Shirley Renshall for her commitment and effort in completing and tracking financial details on a weekly basis. Also, thanks are again extended to Jim Sloan for his work in this area and to Bruce Spaul from the accounting firm of Munro Spaul for his and his staff's time in auditing the accounts of the Centre. All play a significant part on a voluntary basis. |

| Top of Page |

Income and Expendature |

|

| Top of Page |

Balance Sheets |

|

| Top of Page |

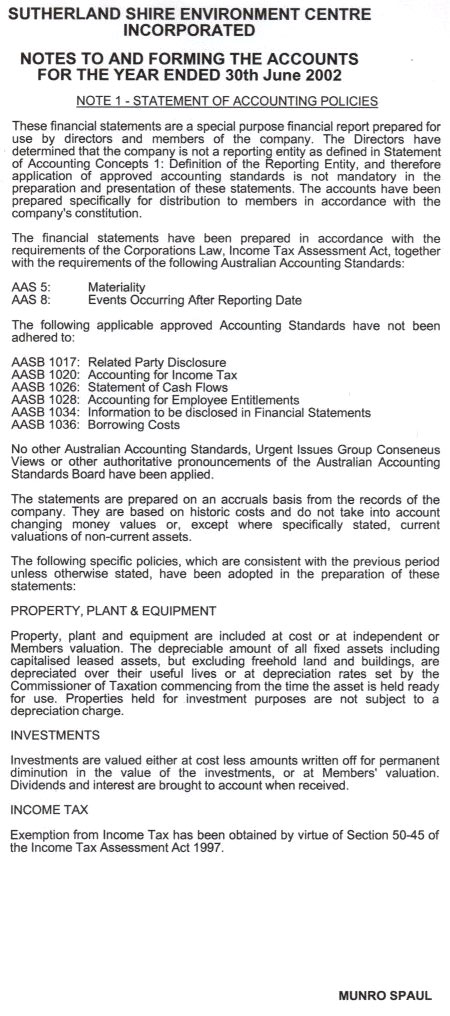

Statement of Accounting Policies |

|

| Top of Page |

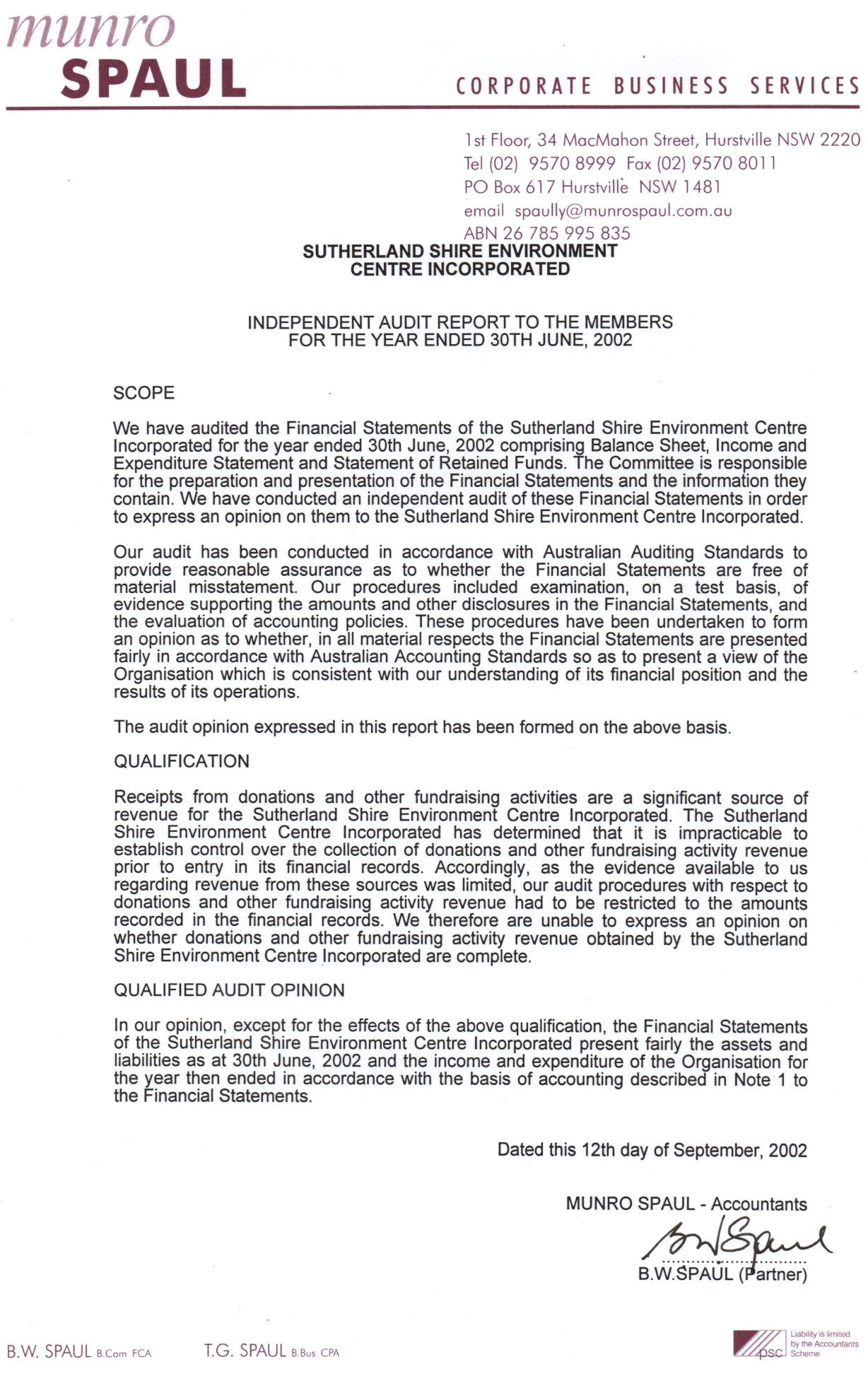

Auditor's Report |

|

| Top of Page |